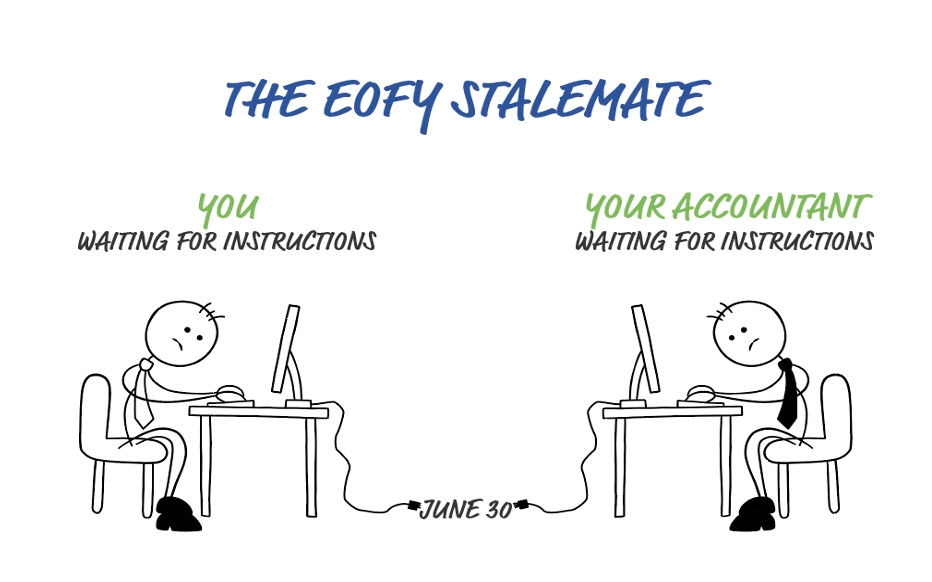

✦ Do you get past June 30 and spend the duration of July waiting patiently for your accountant to send through their annual checklist (like it’s tax homework)? Do you ever stop and think that your accountant is actually sitting at their desk, waiting for YOU to instruct THEM?

When it comes to tax, we have so much a** about in the business game (#sorrynotsorry). And I see so many business owners miss valuable opportunities to both maximise and minimise their tax, all because they see it as a Christmas present they owe their accountant.

If you feel like EOFY is more of a mid-year get-together you’d rather skip out on, here are three things I need you to know to radically change - and improve - your approach to ‘tax time’.

Who is this all for?

Language is critical with this one - do you find yourself saying things like:

I have to reconcile *insert software here* for my accountant

I have to get all my receipts together for my accountant

I have to submit my Q4 BAS so I can finalise everything for my accountant.

I hate to break it to you: your tax return is not a gift for your accountant. (“Yay, you got me a shoebox of receipts… again.”) Not only that, this is the annual tax return for YOUR business.

This isn’t a chore - it’s a fantastic opportunity to dive deep into your numbers and measure your success, inspect your losses, and look for opportunities in the coming year. It should be a time to get curious about the inner workings of your enterprise; to take a pause from the daily doing and check in on your finances. Bring this attitude to your next meeting with your accountant and watch the energy in the room light up!

Stop putting the ATO first

Many business owners see tax time as being like a really crap Christmas.

It’s that magical time of year when we show the Tax Office everything we’ve achieved in the last 12 months, and they tell us if we’ve given them enough of the pie, or if we owe them some more.

If this is how you think about tax, you are missing the point BIG TIME.

For starters, there is no ‘tax time’ (that’s right, crap Christmas just got cancelled. You’re welcome!).

Tax strategy should be a component of your ongoing financial strategy. It should be showing up in your regular check-ins with your numbers throughout the year, as there are opportunities to minimise tax liability across the calendar.

So don’t spend another year realising you did too little, too late.

Make it all about you

You have my permission to indulge in some business self-care this time of year and make it all about you. Seriously. Your accountant is there to ensure you are compliant with the ATO requirements relating to your business. But they shouldn’t be driving this project - YOU SHOULD.

This annual milestone is your reminder to look at the big picture in where your business has been, as well as where it should be heading. Realign with your vision. Map out the coming years. Clarify what’s really important, and ensure your tax plan supports that goal. (Because believe it or not, it can!)

Final thoughts

In my perfect financial world, submitting your tax return as a business owner would be a simple task - because all your numbers would already be in order. You would be striding confidently towards your goals, having full knowledge of your finances, as the systems would be there to keep everything categorised and clear ongoing.

The ATO would just get the card in the mail.

If this sounds too good to be true, I’d invite you to have a FREE 30 minute chat with me. My zone of genius is connecting all the dots above to make ‘going over the numbers’ a time of joy in your business. Where we remember what’s important, and set the intention for the months and years ahead.

I’m kinda like Mrs Claus, but for tax. And when you work with me, finances get a lot more festive.

Contact

Liz Jarvis BEc CA

Better Business Decisions

Phone: D 02 6553 0274 M 0409 570 522 Email: liz@betterbusinessdecisions.com.au

Youtube Channel: https://www.youtube.com/channel/UCd_7znD53DbzVfmLoFPVZWQ

Disclaimer: These are yuck and boring but unfortunately a legal requirement for professionals in my industry. So just a reminder, the information contained here is general in nature and you should seek financial and business advice tailored to your own personal circumstances. Which, by no small coincidence, I can help you out with. Head over to my website and book a free 30 minute chat with me: https://betterbusinessdecisions.com.au/

Advertise with Brilliant-Online

✦ Brilliant-Online is the only publication that offers a single interactive multichannel advertising package.

✦ The purpose of Brilliant-Online is to push for a better world in the digital era.

✦ Brilliant-Online is an empowering read for progressive individuals and dynamic businesses.

✦ For all enquiries about advertising with Brilliant-Online, please contact us here.